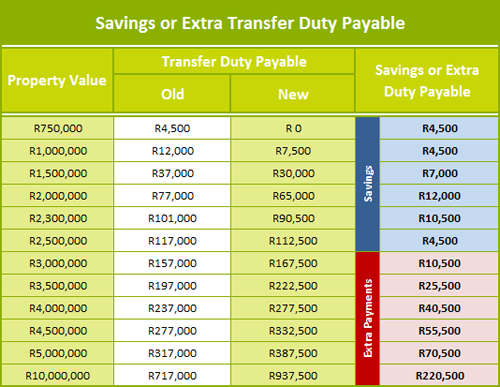

In a nutshell, the transfer duty tax breaks announced in Budget 2015 will reduce costs for most middle-income households but will increase costs of property transactions above about R2,65m (with maximum savings at about the R2m to R2,3m level).

Remember that no transfer duty is payable when VAT applies to a sale.

The new rates

The new exemption level, brackets and transfer duty rates are –

To illustrate…..

If you want to get in touch with us to act in respect of any matter stated herein, please send an email to info@chrisfick.co.za

© DotNews, 2005-2015. This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice.