“Keep your eyes wide open before marriage, half shut afterwards” (Benjamin Franklin)

“Keep your eyes wide open before marriage, half shut afterwards” (Benjamin Franklin)

Whether or not you elect to follow the second part of Ben Franklin’s advice, be sure to follow the first – keep your eyes wide open when choosing which “marital regime” will apply to your marriage.

To ANC or not to ANC? That is the question

Do you or don’t you need an ANC (“antenuptial contract”)?

Firstly, it’s not an admission that you may divorce, so don’t fall into the trap of thinking “we don’t want to even think about divorce so no ANC for us thanks”. Not only do our divorce statistics make that a very short-sighted approach, but your choice now also affects you both during your marriage and when one of you dies.

Secondly, familiarise yourself with the three options that our law allows. The guidelines below are simplified and there are many factors to take into account – seek specific advice on the right option for your particular needs and circumstances. And don’t leave it to the last minute; you are going to be making important decisions here!

Your choices

1. Marriage in community of property

Your assets and liabilities are merged into one “joint estate”. Everything (with only a few specific exceptions) that you bring into, or accrue during, the marriage falls into this joint estate. You will need your spouse’s written consent for some important transactions. On divorce or death the joint estate is split equally between you, regardless of what each of you contributed to the marriage. And if one of you runs up debts or gets into financial difficulties, it is the joint estate that must pay. Your joint estate could even be sequestrated – you risk losing everything. So this option is likely to be unsuitable for many couples – and beware it is the default regime i.e. you will automatically be married in community of property if you don’t specify otherwise in an ANC executed before you marry.

2. Marriage out of community of property without the accrual system

Your own assets and liabilities, both what you bring in and what you accrue during the marriage, remain solely yours to do with as you wish. You don’t need your spouse’s consent for any transactions relating to them. You are not liable for your spouse’s separate debts and if your spouse’s estate is sequestrated you can claim your separate assets back (you will however need to prove that they are indeed yours). Note that if you want to exclude the accrual system your antenuptial contract must specify accordingly. Excluding accrual will be the right choice for some, but be aware that without accrual the poorer spouse (usually a spouse whose contribution to the marriage was more on the home-making side rather than financial) risks being left destitute after many years of marriage.

3. Marriage out of community of property with the accrual system

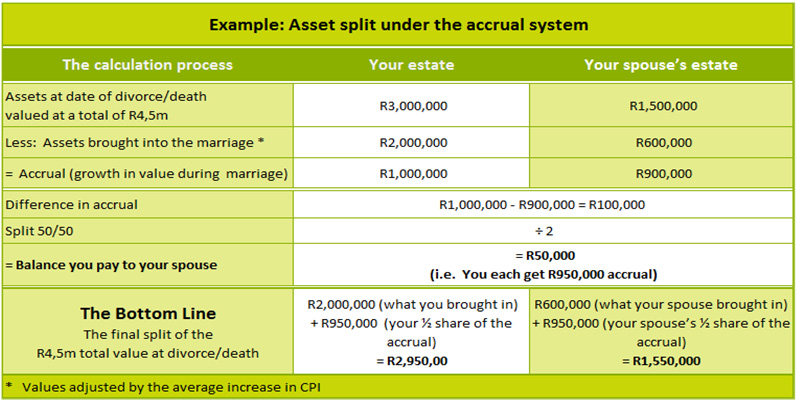

Firstly, although this is generally regarded as the fairest and most popular option for modern marriages, it is not necessarily the best choice for everyone. As with the previous option, your own assets and liabilities remain solely yours, you don’t need your spouse’s consent for any transactions relating to them, and you can protect your assets from your spouse’s creditors. On divorce or death however, you share equally in the “accrual” (growth) of your assets (with a few exceptions) during the marriage, as the table below illustrates:

Tailored ANCs, and a note for the long-married

- Regardless of which regime you choose, take advice on tailoring your ANC to meet your particular needs.

- If you were married before 1 November 1984, different laws apply – take advice for details.

- If you are already married and want to change from one regime to another, you may be able to – take advice on your specific circumstances.

If you want to get in touch with us to act in respect of any matter stated herein, please send an email to info@chrisfick.co.za

© DotNews, 2005-2013. This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice.