If you hold a residential property in the name of a company, CC or trust read on. You have a golden opportunity to save a huge amount of tax – provided you act now.

The background is that SARS wants to lower its administration workload by reducing the number of corporate entities and trusts so it can focus more on taxpayer compliance. As a result, SARS is incentivising you to transfer your residence to a (qualifying) individual now, by allowing you to do so free of transfer duty and dividends tax, and with the Capital Gains Tax (CGT) “rolled over” i.e. not payable until the new individual owner eventually sells the house down the line.

Why bother? Major tax savings

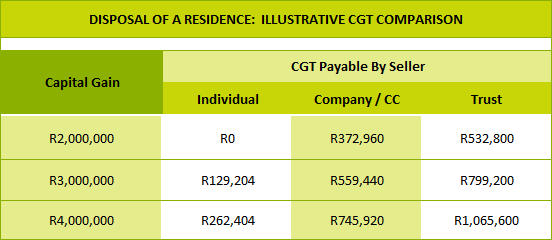

When you eventually sell the residence, you will pay CGT on any “Capital Gain”, and the benefit of this tax break lies in the fact that you are likely to pay a lot less CGT if the property is in an individual’s name than if you keep it in your corporate or trust. The CGT savings flow largely from the fact that only individuals stand to benefit from the “primary residence exclusion” of R2m and the “annual exclusion” of R30 000.

Another potential tax benefit is the saving of a further 15% in dividend tax (not shown in the figures below) which will be payable if your corporate sells the property and then distributes the proceeds.

Have a look at the following table to see just how much CGT you could save by taking advantage of this opportunity.

N.B. The figures shown below should not be taken at face value; they are only a rough guide to illustrate the potential tax savings. Take proper advice on your particular circumstances!

NOTES TO TABLE

- Dividend tax of 15% applies when companies and CCs distribute the proceeds. So if you want to take your profit out of the corporate, you will pay another 15% dividend tax over and above the CGT.

- A “special trust” (i.e. a trust created solely for the benefit of a person who suffers from a mental illness or a person who suffers from any serious physical disability) is treated as an individual in this instance.

- Holiday homes – although the “primary exclusion” of R2m applies only to a “primary residence” and not to a secondary residence such as a holiday home, the tax savings will still be significant.

- On death, the “annual exclusion” increases to R300,000 for the year of death.

- All exclusions are shown at the new, increased rates likely to come into effect shortly.

- CGT for individuals is shown at the maximum marginal rate so it will be a lot less for anyone with a low marginal rate.

- With a trust, you may be able to reduce the CGT substantially by having the proceeds taxed in the hands of a beneficiary with a low tax burden.

The window of opportunity is closing…

You will lose out on these tax savings if you fail to act before the 31 December 2012 deadline.

Don’t delay – this is a complex issue with many grey areas, and you need to take proper advice NOW on these three questions:

1. Do you qualify for the relief?

2. If you do qualify, will it benefit you in your particular circumstances?

3. How should the disposal be structured to give you the maximum benefit?

FAQs

- Do I qualify? Not everyone will qualify, but consult your attorney to check. If your property is mainly used for residential domestic purposes, you are off to a good start.

- Does my holiday house or secondary residence qualify? Yes, the benefit has been extended to houses other than your primary residence, subject to restrictions relating to domestic, rather than business, usage. Remember that the “primary exclusion” of R2m won’t apply here.

- What about my company/trust structure? If you have a “multi-tier” structure (e.g. your company owns the house, and another company or your trust owns the shares in the company) the benefit has also been extended to you. Again, this is subject to restrictions and requirements, so taking advice is essential.

- Even if I qualify, will I benefit? Take full advice on this one – depending on your particular circumstances, there may be good reason to leave the property where it is. Consult a professional on considerations such as estate planning, asset protection, conduiting a trust’s distributions to a beneficiary with a low tax burden, etc.

- Are there any risks? The disposal must be carefully structured by a professional to avoid any triggering of donations tax, dividends tax, adverse tax effects of any loan accounts etc. If the property is bonded, remember to give the bank timeous notice of cancellation, and also check that the transferee will qualify for a new bond (and if so, at what interest rate).

- To whom should I transfer the property, how should I dispose of it, and at what price? Once again, take advice here – everyone’s circumstances will be different, and there are many considerations.

- When must I dispose of it by? 31 December 2012.

- What will it cost me? The good news is that there is no transfer duty payable, and CGT is “rolled over” i.e. not payable now. Provide for conveyancer’s fees, bond cancellation and registration fees, the cost to deregister or liquidate entities etc.

- Once I have moved my residence into my name, how long do I have before de-registering or liquidating the entity that owned the residence? SARS gives you six months to begin these proceedings and will probably give an extension if you ask. If there are other assets in these entities, SARS have made concessions to help you – speak to a professional.

Take advice, and take it now!

This is serious stuff, with the potential for huge savings, but also the potential for significant losses if incorrectly handled. The complexities make it essential to get started now!

© DotNews, 2005-2013. This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice.